Yield to maturity bond formula excel 225790-How to calculate yield to maturity in excel

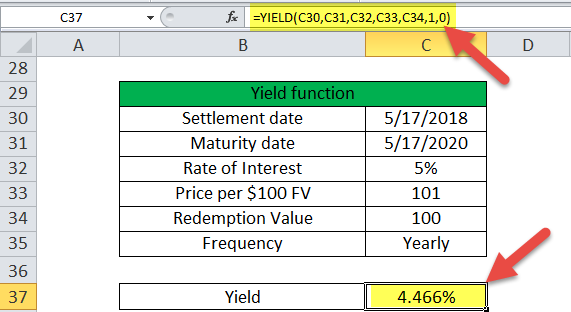

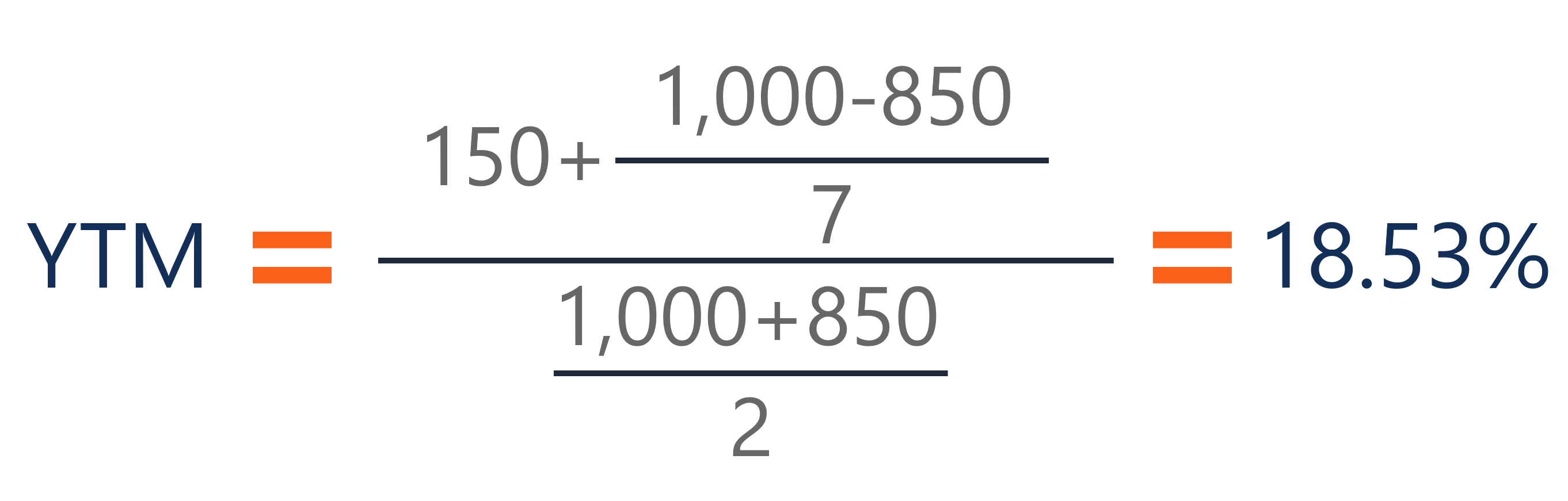

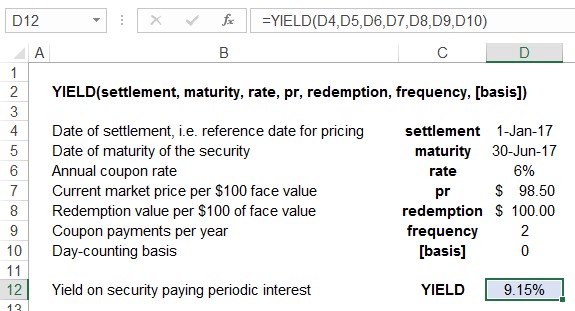

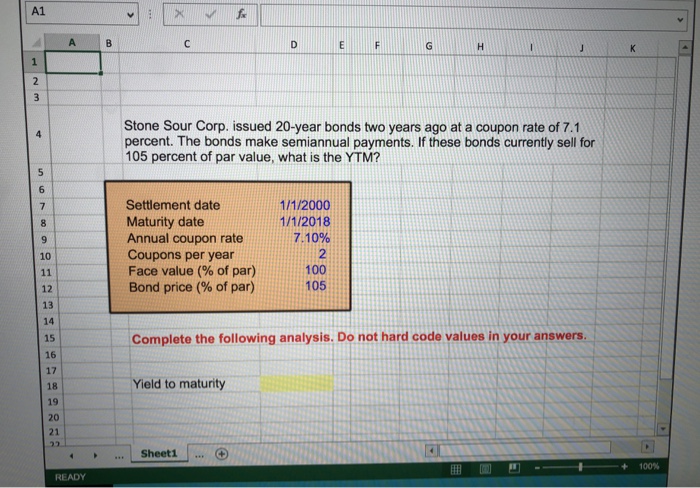

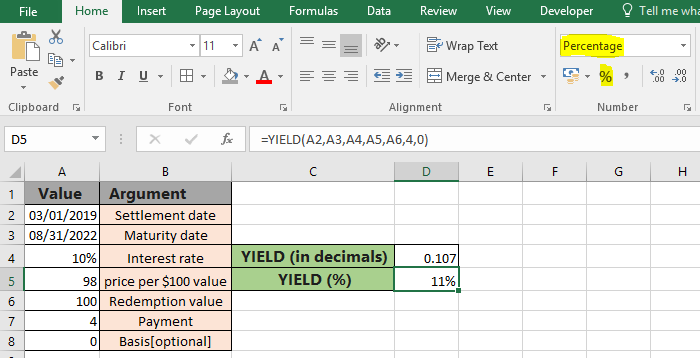

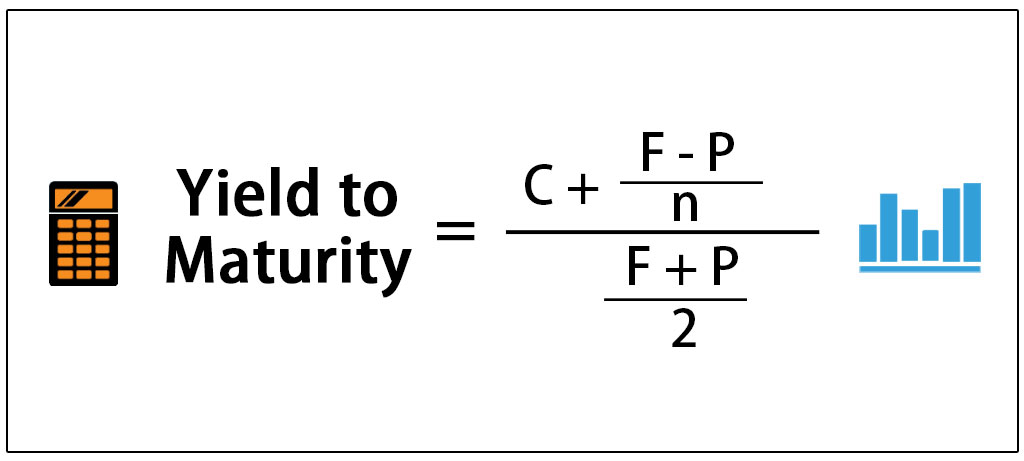

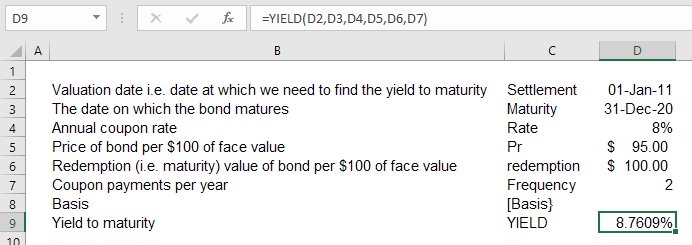

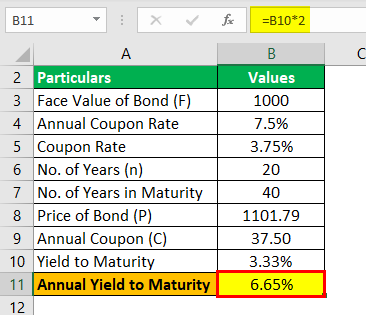

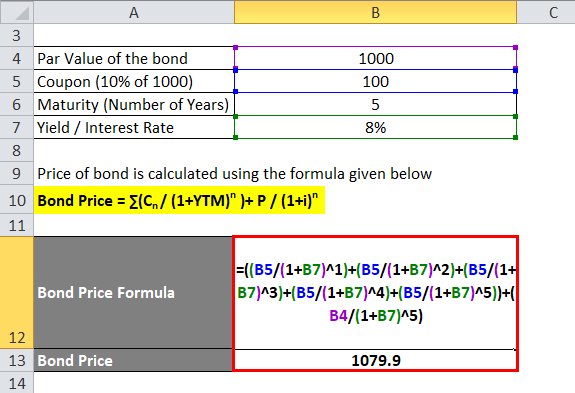

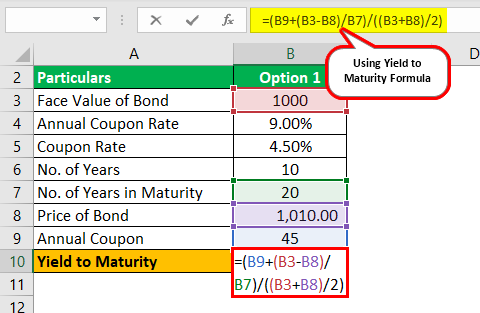

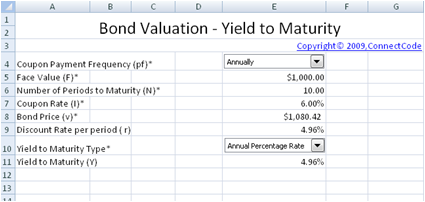

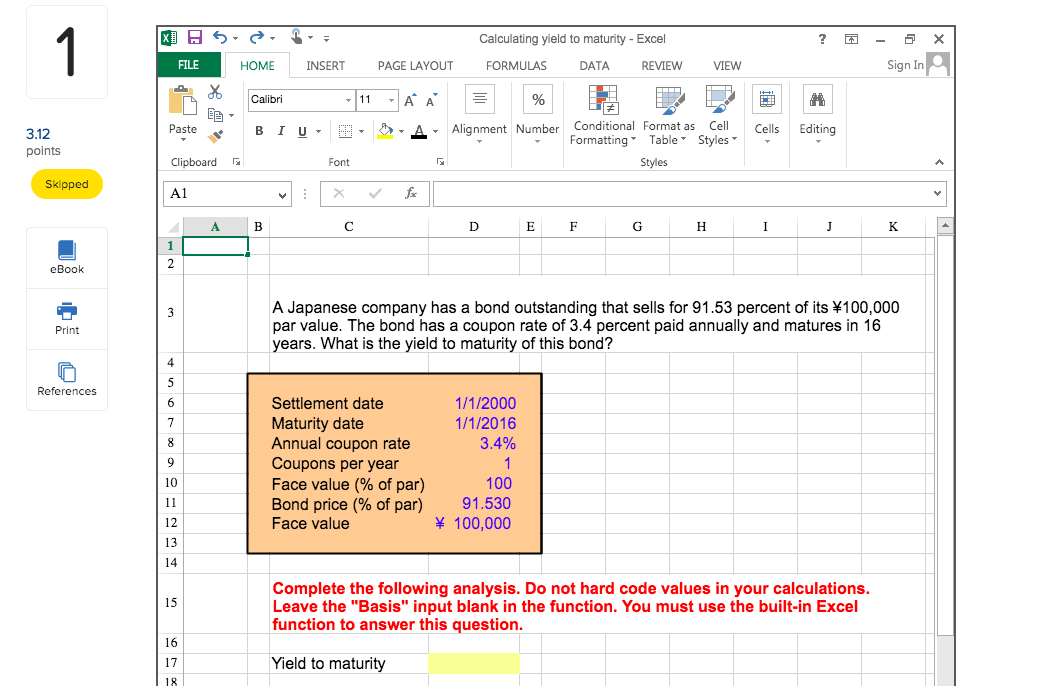

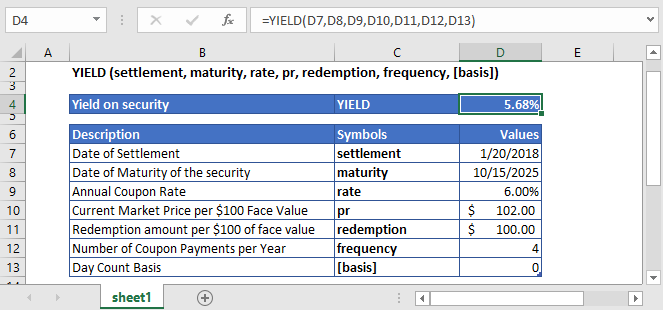

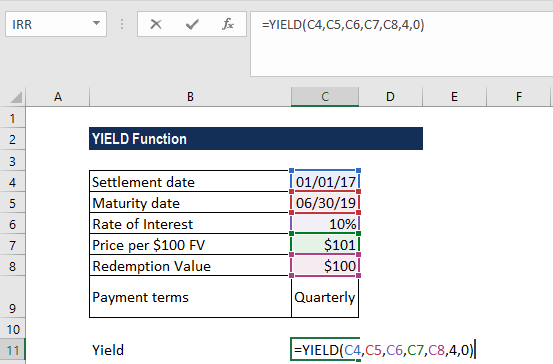

A coupon rate of 10% (ie a yearly coupon payment of $100) and oneLet's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown belowThis article describes the formula syntax and usage of the YIELD function in Microsoft Excel Description Returns the yield on a security that pays periodic interest Use YIELD to calculate bond yield Syntax YIELD(settlement, maturity, rate, pr, redemption, frequency, basis)

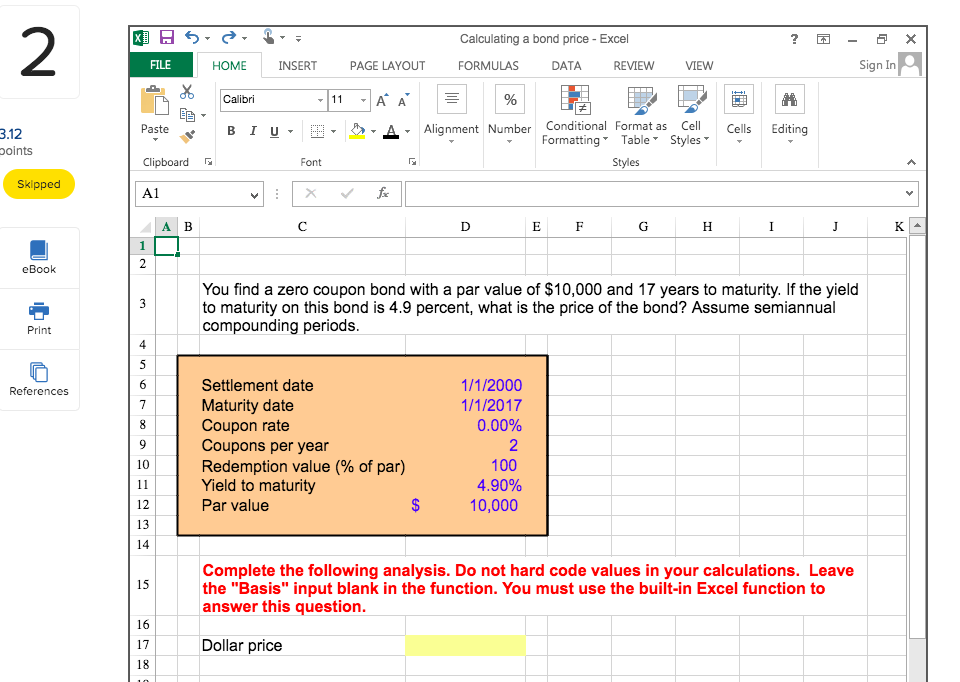

Bond Yield To Maturity Excel Formula Cells In Blue Are Course Hero

How to calculate yield to maturity in excel

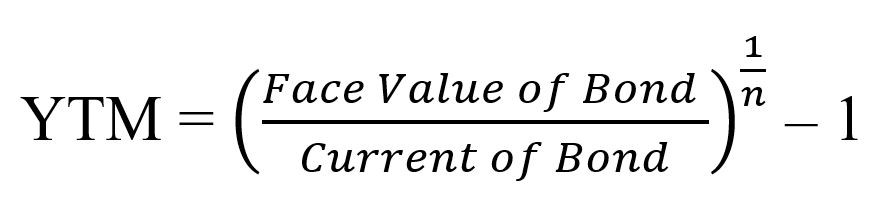

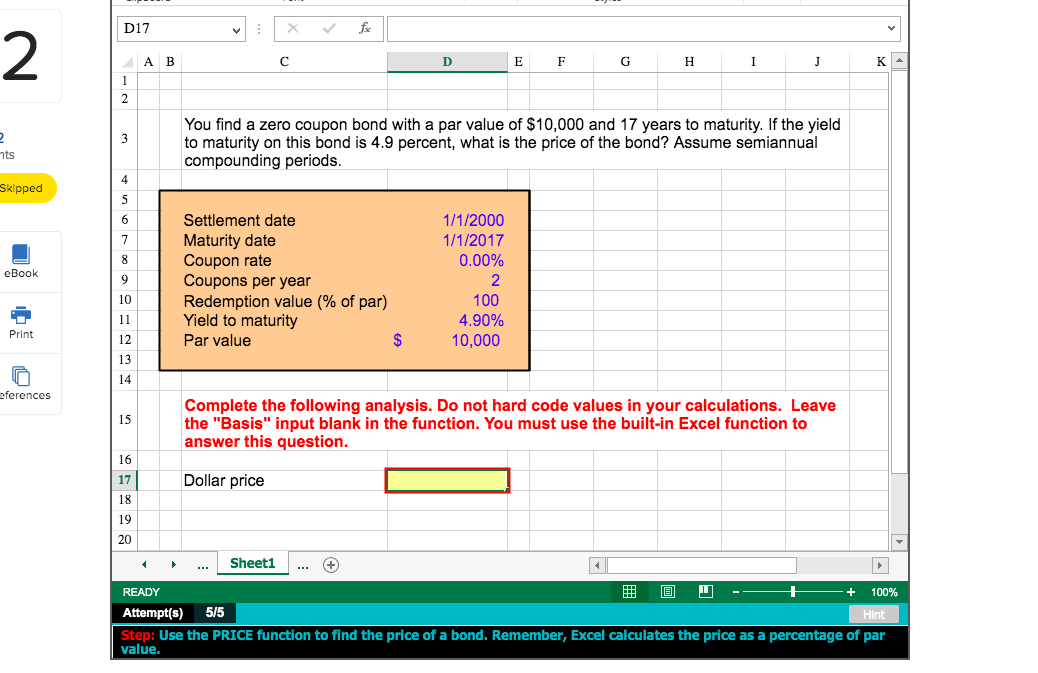

How to calculate yield to maturity in excel-The formula for calculating the yield to maturity on a zerocoupon bond is Yield To Maturity=(Face Value/Current Bond Price)^(1/Years To Maturity)−1 Consider a $1,000 zerocoupon bond that hasRedemption is the value received by the bondholder at the expiry of the bond representing the repayment of principal;

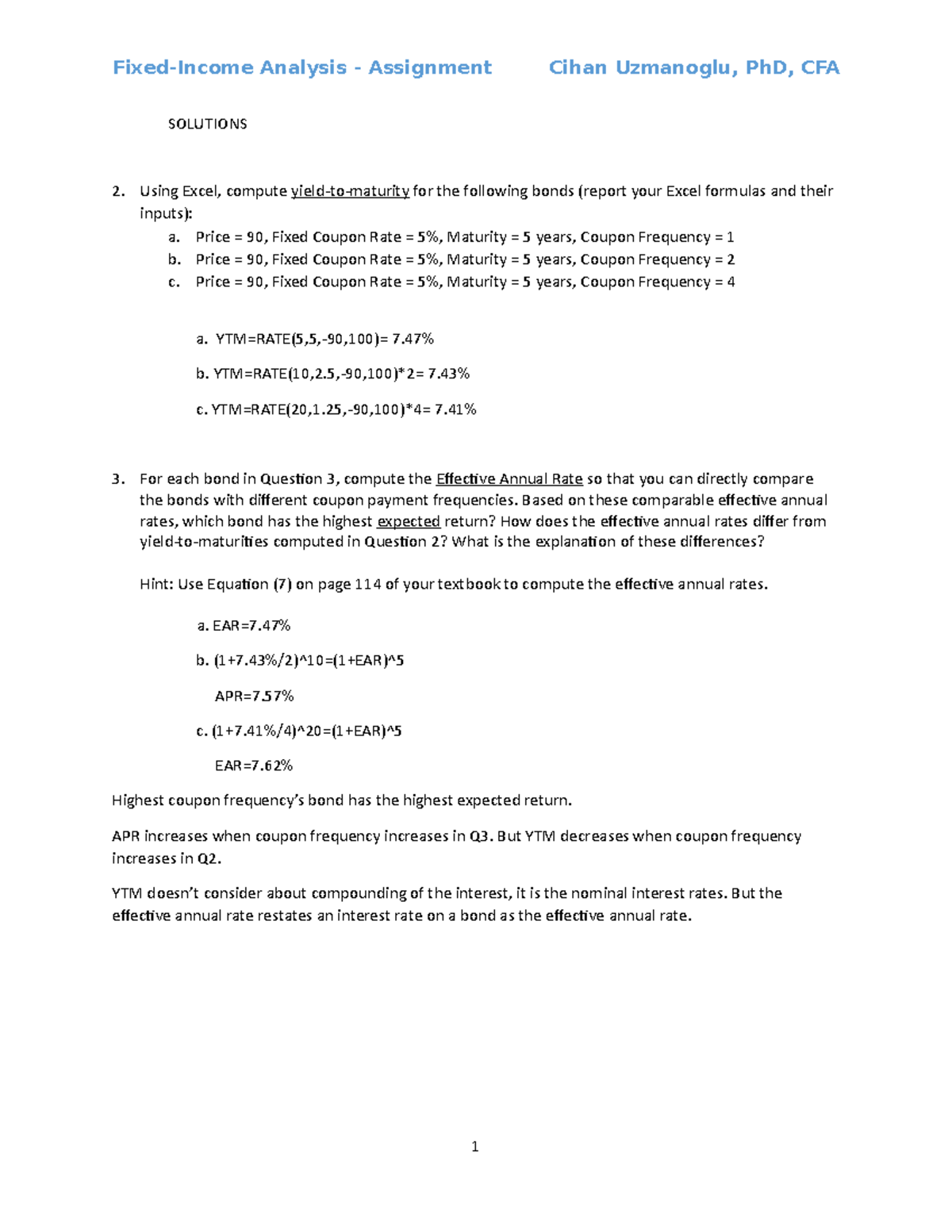

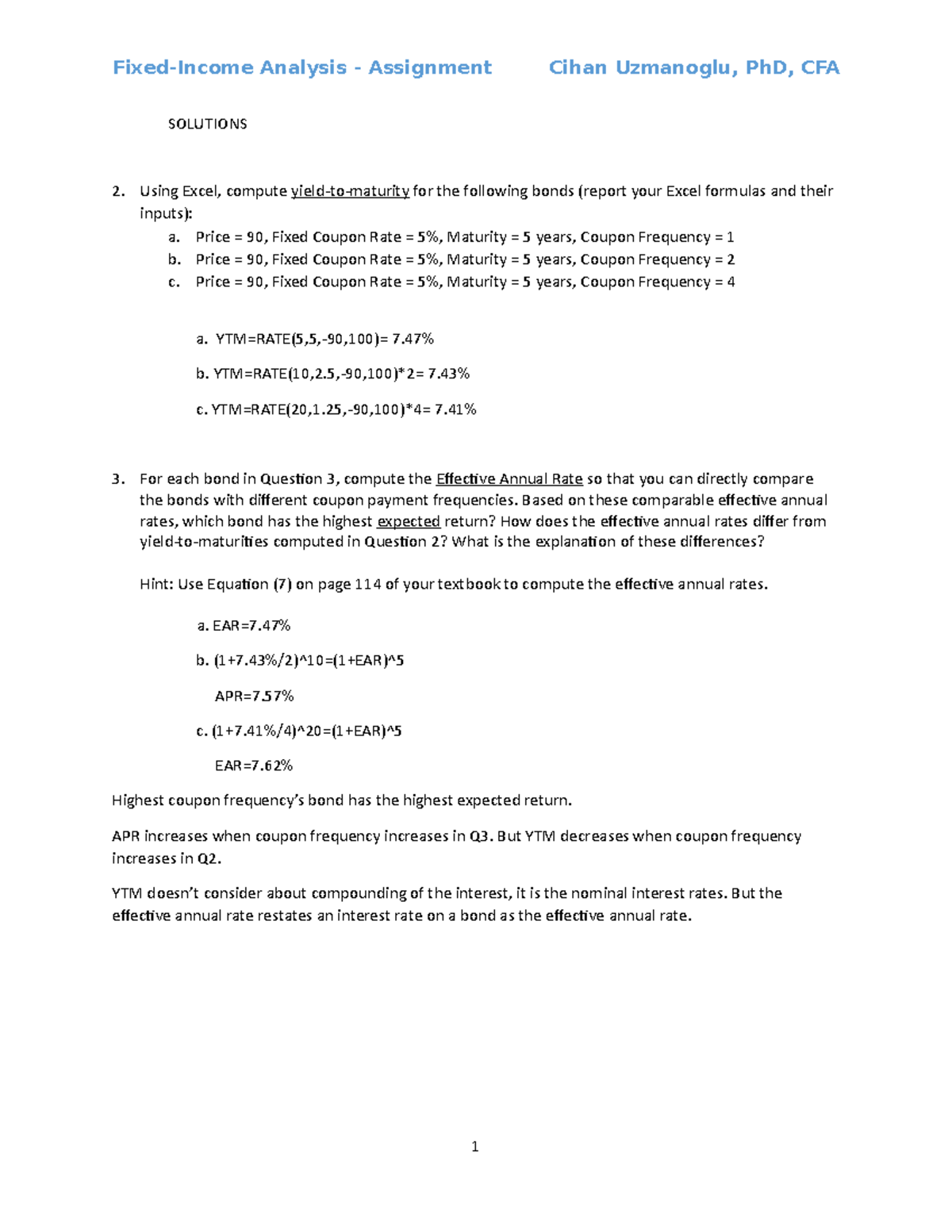

Homework 2 Solutions 2 Copy Studocu

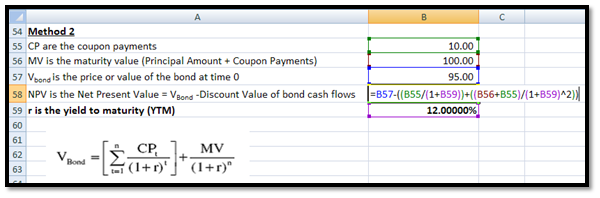

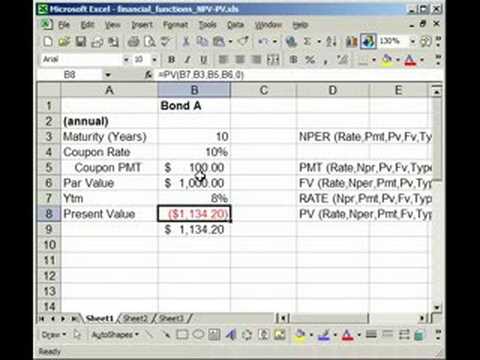

C How to calculate the Yield to Maturity (YTM) of a bond The equation below gives the value of a bond at time 0 The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount Coupon payment) have been discounted at the yieldtomaturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond) PV = P ( 1 r ) 1 P ( 1 r ) 2 ⋯ P Principal ( 1 r ) n where PV = present value of the bond P = payment, or coupon rate × par value ÷ number of payments per year r = requiredCreate Yield to maturity formula in VBA Thread starter Spurious;

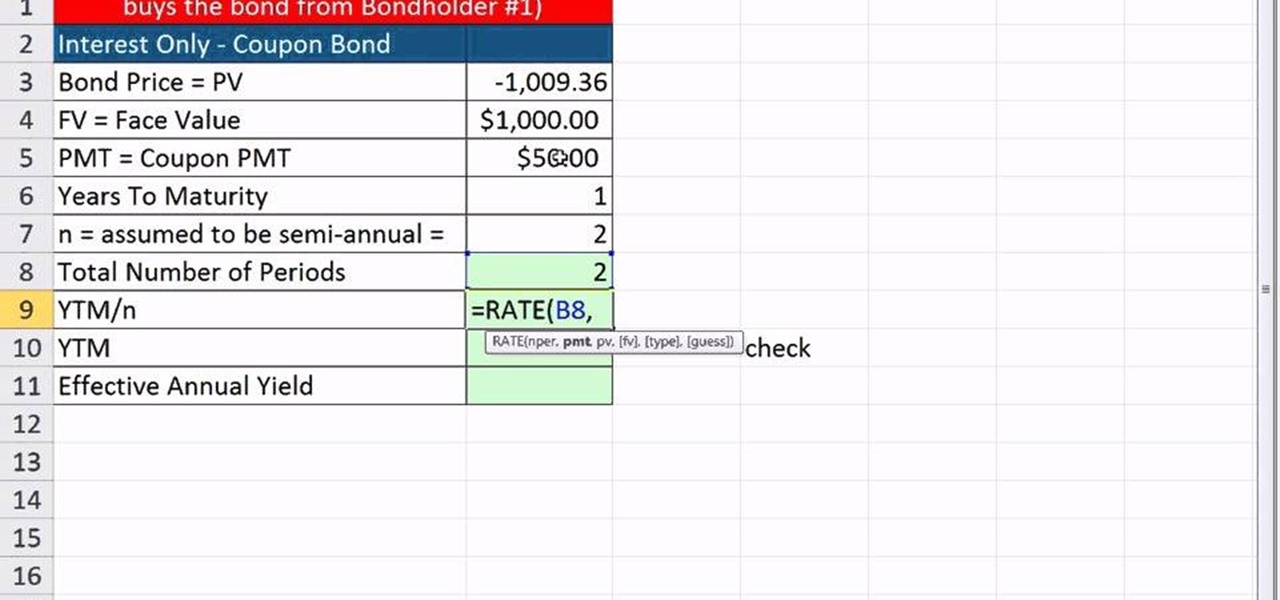

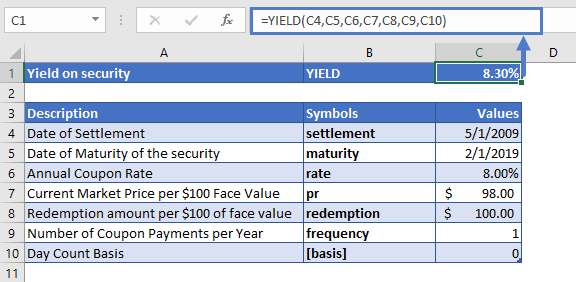

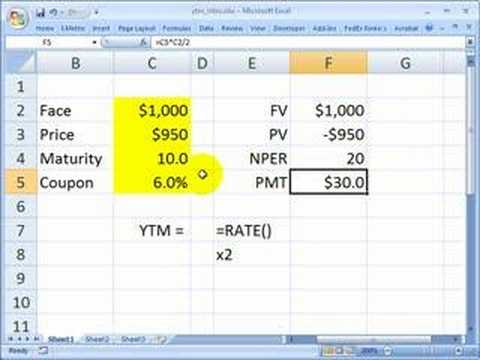

S Spurious Active Member Joined Dec 14, 10 Messages 439 Mar 29, 11 #1 Hello guys, I dont want to use regular Excel Thanks in advance Some videos you may like Excel Facts Did you know Excel offers Filter by Selection?Yield to maturity (YTM) is the annual return that a bond is expected to generate if it is held till its maturity given its coupon rate, payment frequency and current market price Yield to maturity is essentially the internal rate of return of a bond ie the discount rate at which the present value of a bond's coupon payments and maturity value is equal to its current market priceCalculate Yield of a 10 Year Bond Now let's calculate the yield of a 10year bond, which was issued on February 1, 09, and was purchased by the investor three months later Other details of the bond are mentioned in the above table The formula used to calculate the Yield is =YIELD(C4,C5,C6,C7,C8,C9,C10)

A coupon rate of 10% (ie a yearly coupon payment of $100) and oneA = number of days from the beginning of the coupon period to the settlement date (accrued days) DSR = number of days from the settlement date to the redemption date E = number of days in the coupon period If there is more than one coupon period until redemption, YIELD is calculated through a hundred iterationsStart date Mar 29, 11;

Excel Finance Class 48 Calculate Ytm And Effective Annual Yield From Bond Cash Flows Rate Effect Youtube

How To Calculate Pv Of A Different Bond Type With Excel

Yield to maturity (YTM) is the annual return that a bond is expected to generate if it is held till its maturity given its coupon rate, payment frequency and current market price Yield to maturity is essentially the internal rate of return of a bond ie the discount rate at which the present value of a bond's coupon payments and maturity value is equal to its current market priceThe YIELD Function is categorized under Excel Financial functions It will calculate the yield on a security that pays periodic interest The function is generally used to calculate bond yield As a financial analyst, we often calculate the yield on a bond to determine the income that would be generated in aThere is no builtin function to calculate the current yield, so you must use this formula For the example bond, enter the following formula into B13 =(*B2)/B10 The current yield is 2% Note that the current yield only takes into account the expected interest payments It completely ignores expected price changes (capital gains or losses)

Yield Function In Excel Calculate Yield In Excel With Examples

How To Calculate Pv Of A Different Bond Type With Excel

This is not a problem, as Excel has builtin financial formulas which solve this equation internally Yield to maturity considers not only the current coupon income, but any capital gain or loss realized by holding the bond to maturity Yield to maturity on the coupon dateS Spurious Active Member Joined Dec 14, 10 Messages 439 Mar 29, 11 #1 Hello guys, I dont want to use regular Excel Thanks in advance Some videos you may like Excel Facts Did you know Excel offers Filter by Selection?Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compounding

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Bond Key Rate Duration Krd In Excel Calculating And Understanding Resources

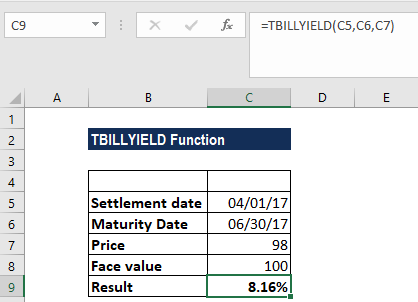

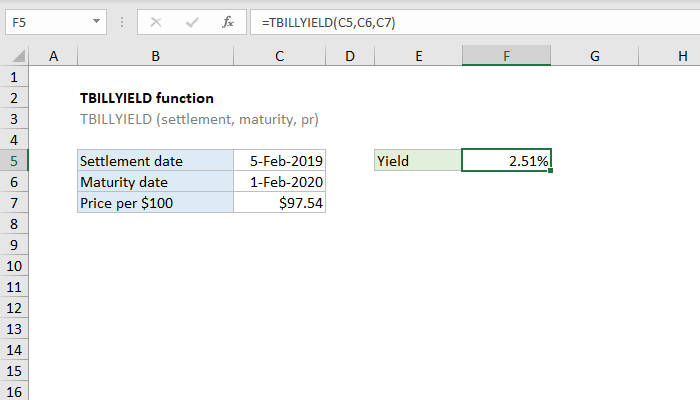

The Excel TBILLEQ function returns the bondequivalent yield for a Treasury bill, based on based on a settlement date, a maturity date, and a discount rate In the example shown, the settlement date is 5Feb19, the maturity date is 1Feb, and the discount rate is 254% The formula in F5 is =To calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (eg, A1 through A3)Frequency refers to number of periodic interest

Homework 2 Solutions 2 Copy Studocu

Yield To Maturity Ytm Overview Formula And Importance

A bond is a financial instrument in which the bond issuer owes the bond holder a periodic payment (known as a coupon, usually paid once or twice a year) and the face value (or par value) of the bond, paid at maturity Consider a 10year bond with a face value of $1000;The formula of Days Payable Outstanding;Yield to Maturity(YTM) can be described as total anticipated return which an investor will earn on his/her investments starting from date of investment till the ultimate due date of maturity (generally calculated for bonds, debentures, etc), YTM is generally confused with annual rate of return which is different from YTM or else YTM can be described as discount rate

Excel Yield Function

Yield To Maturity Calculation In Excel Example

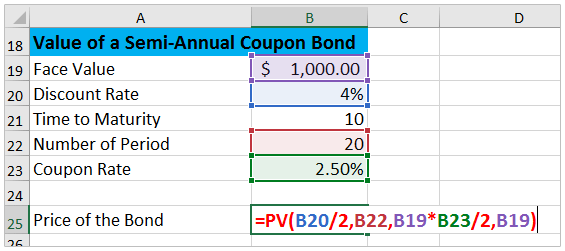

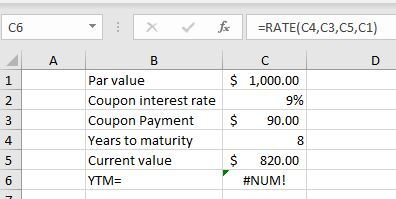

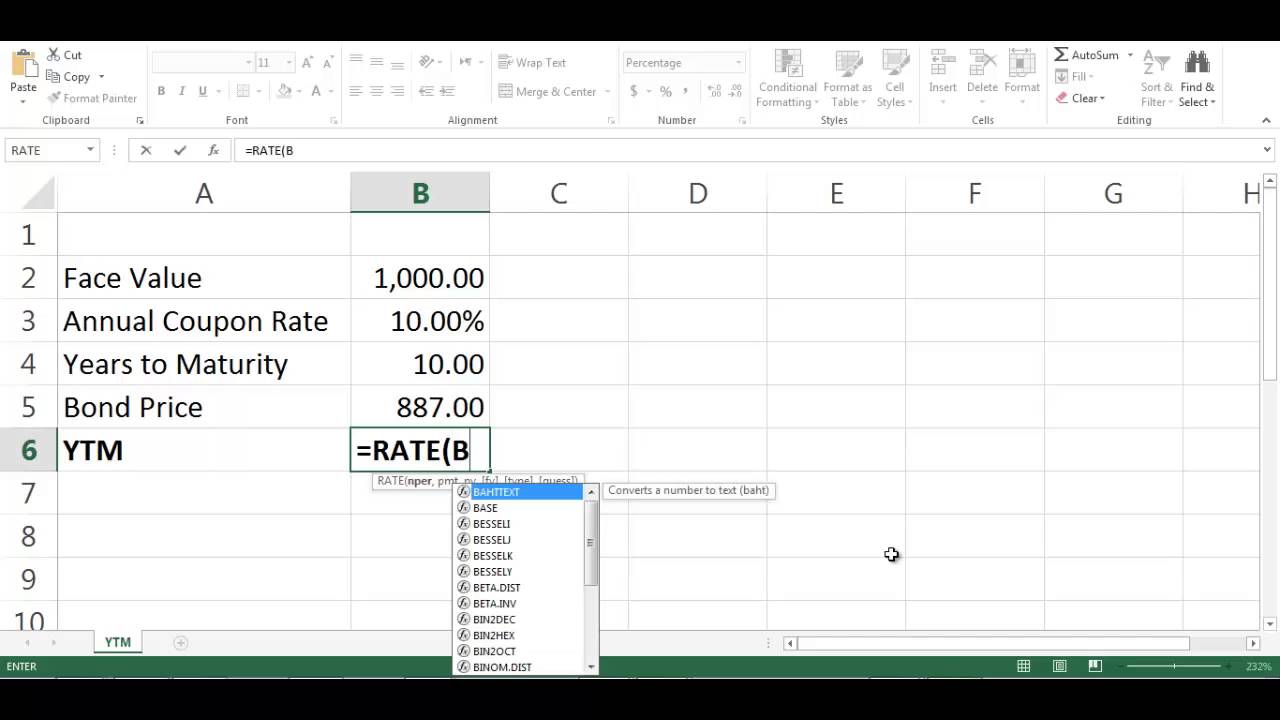

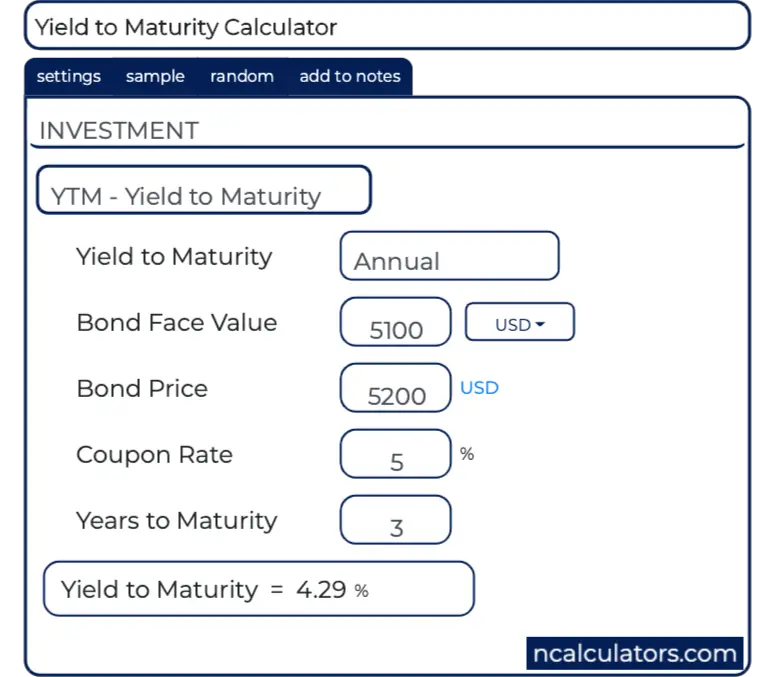

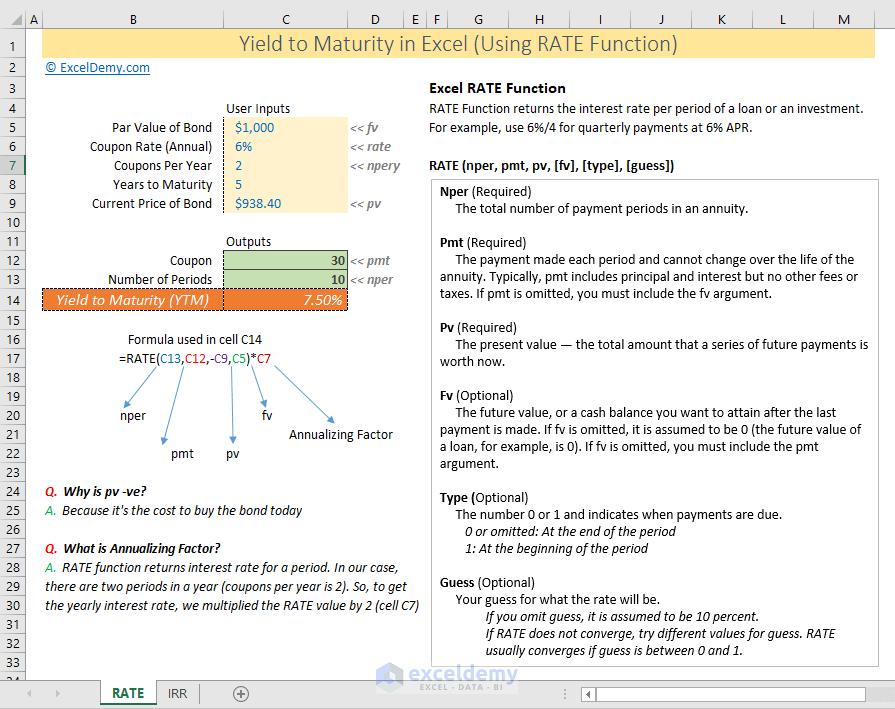

The discount rate, in this case, is known as the yield to maturity (YTM) We can calculate bond yields using the RATE function in Excel This feature takes care of the iterations and calculates the bond yield in one go Example Bond Yield An investor purchased a 5year 4% coupon bond with annual payments at a price of %The Excel TBILLEQ function returns the bondequivalent yield for a Treasury bill, based on based on a settlement date, a maturity date, and a discount rate In the example shown, the settlement date is 5Feb19, the maturity date is 1Feb, and the discount rate is 254% The formula in F5 is =/ Excel Formula for Yield to Maturity The YTM is easy to compute where the acquisition cost of a bond is at par and coupon payments are effected annually In such a situation, the yieldtomaturity will be equal to coupon payment However, for other cases, an approximate YTM can be found by using a bond yield table

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Solved Calculate The Ytm Using Excel Formula And Cells S Chegg Com

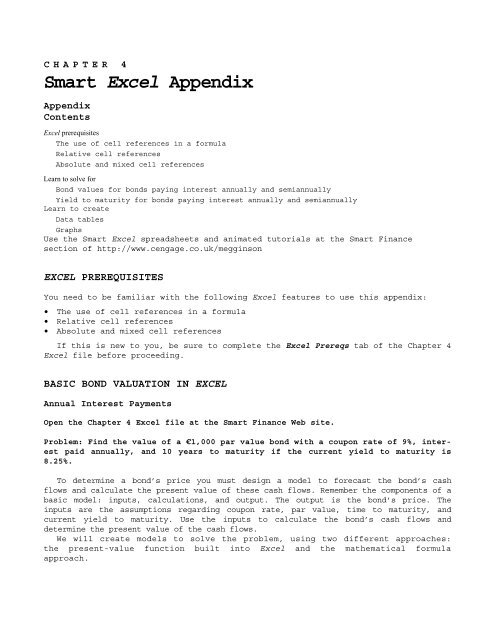

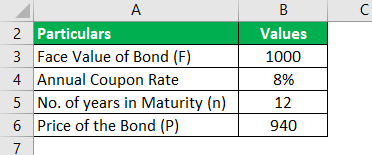

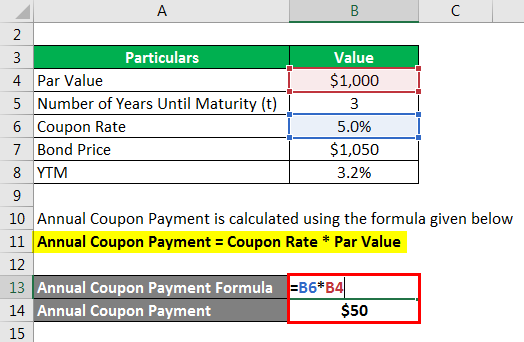

Draw a time line for a 3year bond with a coupon rate of 8% per year paid semiannually The bond has a face value of $1,000 The bond has three years until maturity and it pays interest semiannually, so the time line needs to show six periods The bond will pay 8% of the $1,000 face value in interest every yearI'm looking for a formula that gives me the current yield to maturity (YTM) for a bond, that takes into account the frequency of coupon (Monthly, SemiAnnual or Annual) and the effect of compound interest For example A1 = Today () B1 = Maturity Date C1 = Coupon (M, S, A) D1 = Present ValueIf I have a corporate bond with the face value of 1,000 with a coupon rate of 9 and a current market value of 850 for 10 years what the yield to maturity This thread is locked You can follow the question or vote as helpful, but you cannot reply to this thread

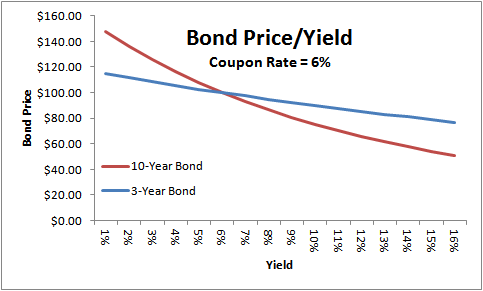

Duration And Convexity With Illustrations And Formulas

Quant Bonds Between Coupon Dates

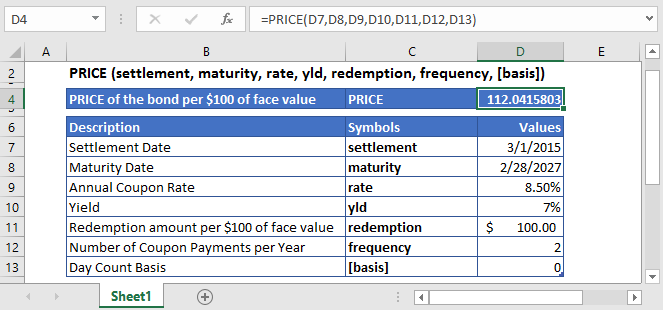

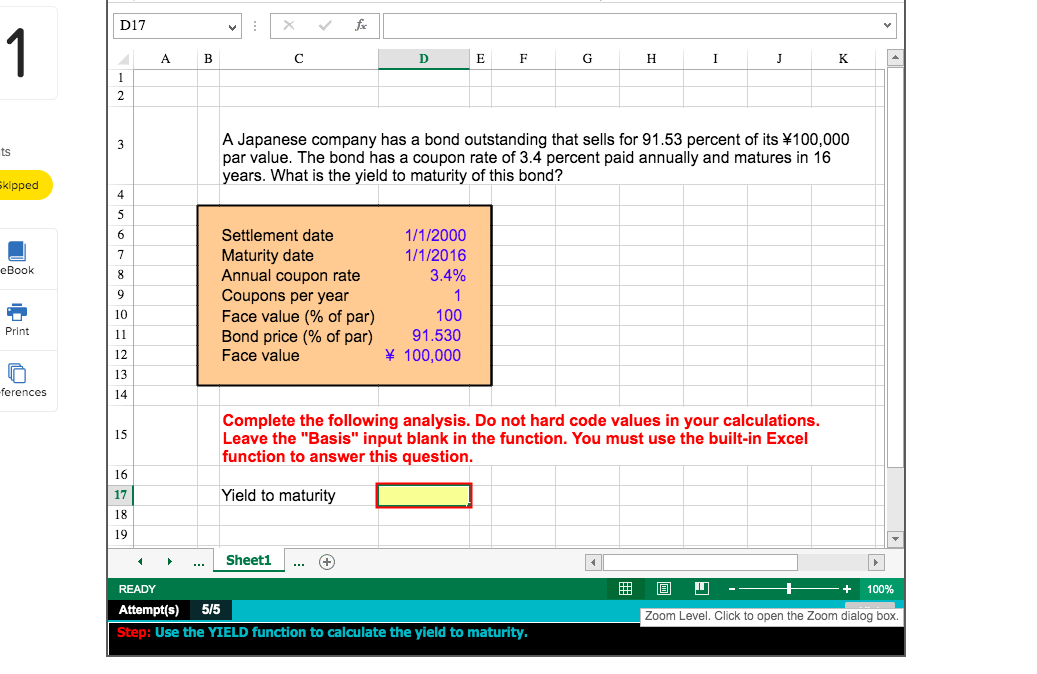

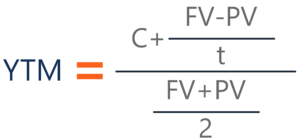

The formula's syntax is YIELD (settlement, maturity, rate, pr, redemption, frequency, basis Settlement refers to the settlement date ie the reference date for pricing, maturity is the maturity date ie the date on which the securityholder receives principal back, Pr stands for the current market price of the security;How is YTM Calculated ?C How to calculate the Yield to Maturity (YTM) of a bond The equation below gives the value of a bond at time 0 The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount Coupon payment) have been discounted at the yieldtomaturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond)

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

Yield to Maturity (YTM) is the most commonly used and comprehensive measure of risk In fact, if someone talks about just 'Yield' they are most likely referring to Yield to Maturity In simple terms, YTM is the discount rate that makes the present value of the future bond payments (coupons and par) equal to the market price of the bond plusThe formula of Bond Equivalent YieldP = Bond Price;

How To Use The Yield Function In Excel

Finding Yield To Maturity Using Excel Youtube

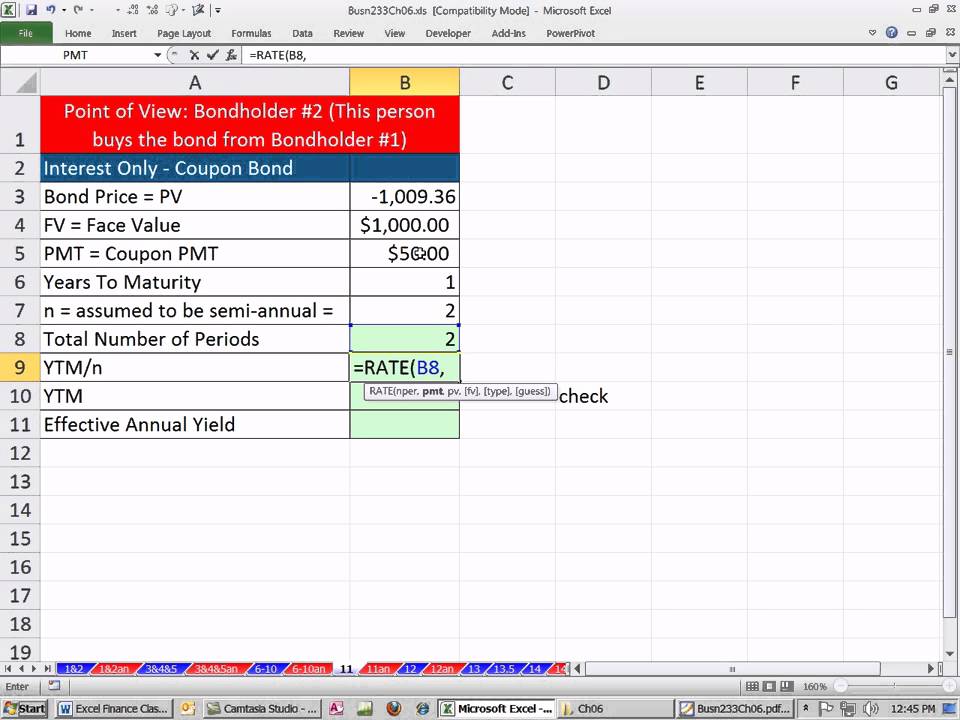

This has been a guide to Bond Yield Formula Here we discuss the formula for calculating bond yield along with practical examples and a downloadable excel template You can learn more about financial analysis from the following articles – Types – High Yield Bonds;You're wondering whether you would invest in the bond To make this decision, you want to know the Yield to Maturity (also called Internal Rate of Return) from investing in the bond You can use Excel's RATE function to calculate the Yield to Maturity (YTM) Check out the image below The syntax of RATE function RATE (nper, pmt, pv, fv, type, guess) Here, Nper = Total number of periods of the bond maturity Years to maturity of the bond is 5 yearsStart date Mar 29, 11;

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Yield To Maturity Definition How To Calculate Ytm Pros Cons

What is Yield to Maturity?C = the semiannual coupon interest;A bond is a financial instrument in which the bond issuer owes the bond holder a periodic payment (known as a coupon, usually paid once or twice a year) and the face value (or par value) of the bond, paid at maturity Consider a 10year bond with a face value of $1000;

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Professional Bond Valuation And Yield To Maturity Spreadsheet

Definition The yield to maturity (YTM) of a bond is the internal rate of return (IRR) if the bond is held until the maturity date In other words, YTM can be defined as the discount rate at which the present value of all coupon payments and face value is equal to the current market price of a bondExamples of Coupon Bond Formula (With Excel Template) In this case, the coupon rate is 5% but to be paid semiannually, while the yield to maturity is currently at 45% Two years have passed since bond issuance and as such there are 8 years left until maturity Calculate the market price of the bonds based on the new informationIf I have a corporate bond with the face value of 1,000 with a coupon rate of 9 and a current market value of 850 for 10 years what the yield to maturity This thread is locked You can follow the question or vote as helpful, but you cannot reply to this thread

How To Calculate Effective Interest Rate On Bonds Using Excel

Q Tbn And9gcspsw0gvryuir4hbunmr9ryyqtt9uvaiwo4js Vmypouh4p4lqk Usqp Cau

The YIELD Function is categorized under Excel Financial functions It will calculate the yield on a security that pays periodic interest The function is generally used to calculate bond yield As a financial analyst, we often calculate the yield on a bond to determine the income that would be generated in aI'm looking for a formula that gives me the current yield to maturity (YTM) for a bond, that takes into account the frequency of coupon (Monthly, SemiAnnual or Annual) and the effect of compound interest For example A1 = Today () B1 = Maturity Date C1 = Coupon (M, S, A) D1 = Present ValueIf a bond is "callable," it means that the issuer has the right to buy the bond back at a predetermined date before its full maturity date The call could happen at the bond's face value, or the

Deriving The Bond Pricing Formula

What You Must Know On Bond Valuation And Yield To Maturity Acca Afm Got It Pass

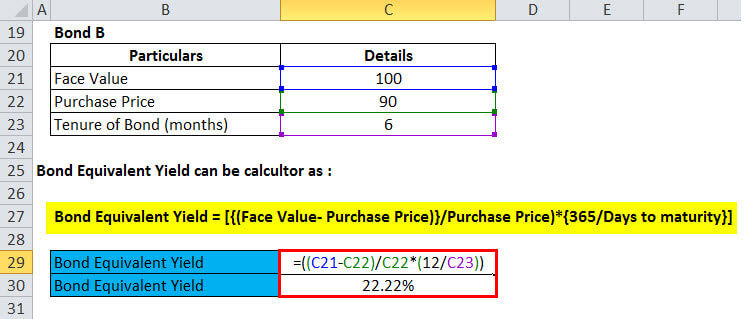

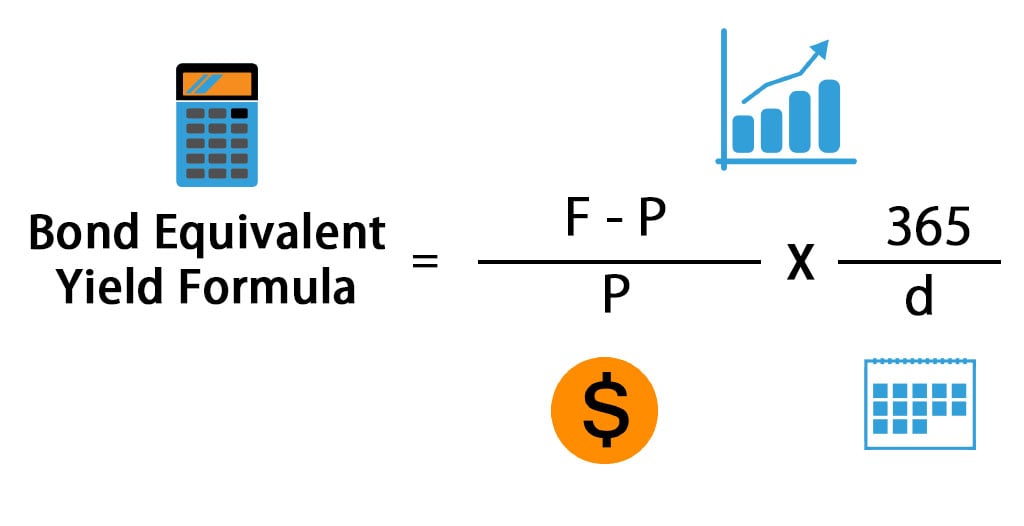

The discount rate, in this case, is known as the yield to maturity (YTM) We can calculate bond yields using the RATE function in Excel This feature takes care of the iterations and calculates the bond yield in one go Example Bond Yield An investor purchased a 5year 4% coupon bond with annual payments at a price of %An example of finding the YTM (yield to maturity) of a bond using the =RATE formula in ExcelFormula to Calculate Bond Equivalent Yield (BEY) The formula is used in order to calculate the bond equivalent yield by ascertaining the difference between the bonds nominal or face value and its purchase price and these results must be divided by its price and these results must be further multiplied by 365 and then divided by the remaining days left until the maturity date

How To Calculate Bond Price In Excel

Bond Valuation Wikipedia

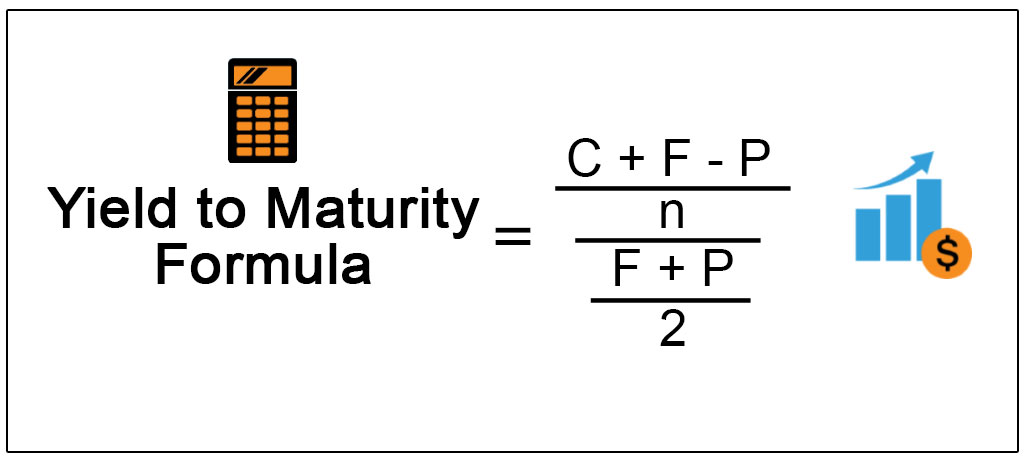

N = number of semiannual periods left to maturity;Create Yield to maturity formula in VBA Thread starter Spurious;Yield to maturity can be mathematically derived and calculated from the formula YTM is therefore a good measurement gauge for the expected investment return of a bond When it comes to online calculation, this Yield to Maturity calculator can help you to determine the expected investment return of a bond according to the respective input values

How To Use The Excel Yield Function Exceljet

Yield To Maturity Ytm Definition Formula And Example

The yield to maturity formula is used to calculate the yield on a bond based on its current price on the market The yield to maturity formula looks at the effective yield of a bond based on compounding as opposed to the simple yield which is found using the dividend yield formulaThe discount rate, in this case, is known as the yield to maturity (YTM) We can calculate bond yields using the RATE function in Excel This feature takes care of the iterations and calculates the bond yield in one go Example Bond Yield An investor purchased a 5year 4% coupon bond with annual payments at a price of %How to Calculate Bond Yield to Maturity Using Excel Open a Blank Excel Spreadsheet In Excel click "File" then "New" using the toolbar at the top of the screen Set Up the Assumption Labels Enter the Dates Enter the settlement date into cell B2 The settlement date is when an investor buys the

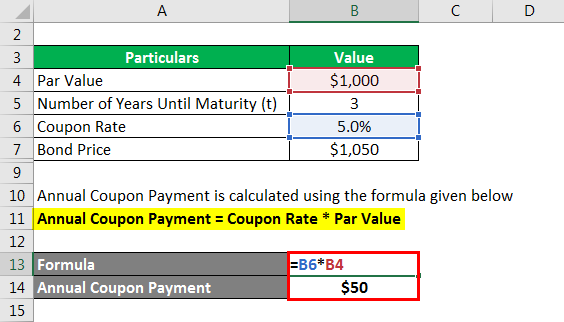

Chapter 4 Cengage Learning

Yield To Maturity Formula Step By Step Calculation With Examples

The yield to maturity formula is used to calculate the yield on a bond based on its current price on the market The yield to maturity formula looks at the effective yield of a bond based on compounding as opposed to the simple yield which is found using the dividend yield formulaBefore the maturity date, the bondholder cannot get any coupon as below screenshot shown You can calculate the price of this zero coupon bond as follows Select the cell you will place the calculated result at, type the formula =PV(B4,,0,B2) into it, and press the Enter key See screenshotIn this video, I show how to find YTM of a bond in Excel In this video, I show how to find YTM of a bond in Excel

Bond Price Calculator Present Value Of Future Cashflows Dqydj

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Microsoft Excel Bond Valuation Tvmcalcs Com

Microsoft Excel Bond Valuation Tvmcalcs Com

Best Excel Tutorial How To Calculate Yield In Excel

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Calculating Yield To Maturity Of A Zero Coupon Bond

Bond Yield Formula Laptrinhx

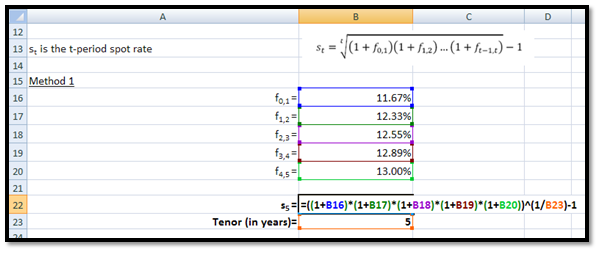

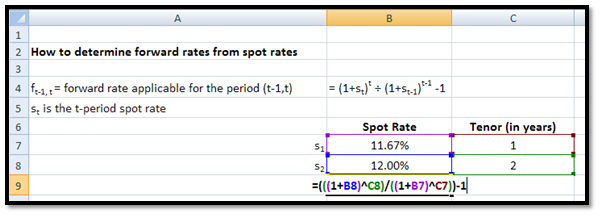

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

3 Ways To Bootstrap Spot Rates For The Treasury Yield Curve Excel Cfo

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

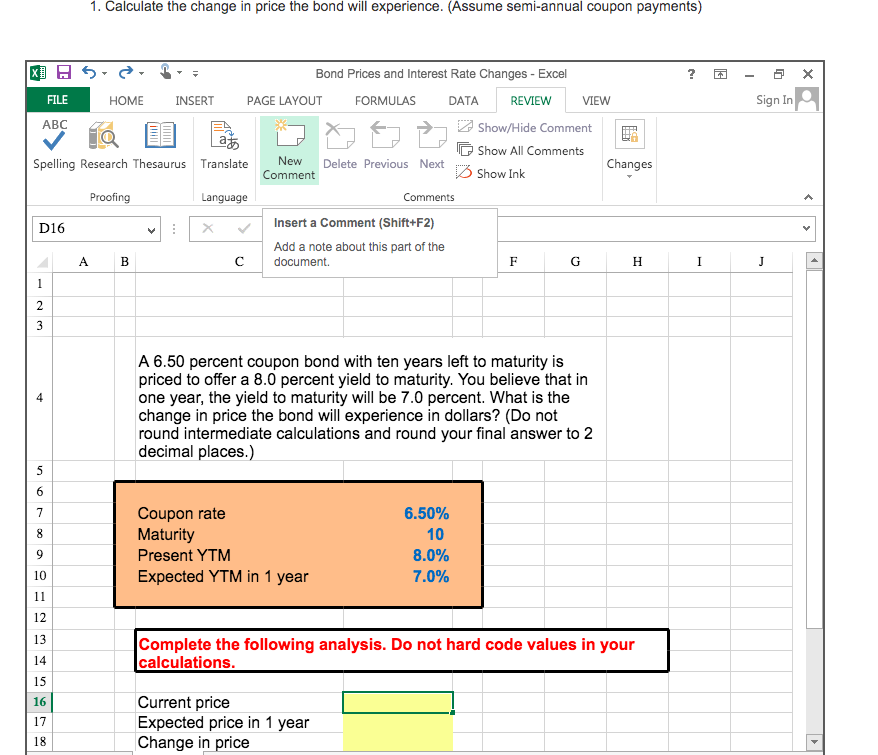

Solved 1 Calculate The Change In Price The Bond Will Exp Chegg Com

Price Function Calculate Bond Price Excel Google Sheet Automate Excel

Bond Yield To Maturity Excel Formula Cells In Blue Are Course Hero

Excel Help Calculating Yield To Maturity For A Bond

1

Tbillyield Function Formula Examples Calculate Bond Yield

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Yield To Maturity Formula Step By Step Calculation With Examples

Learn To Calculate Yield To Maturity In Ms Excel

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

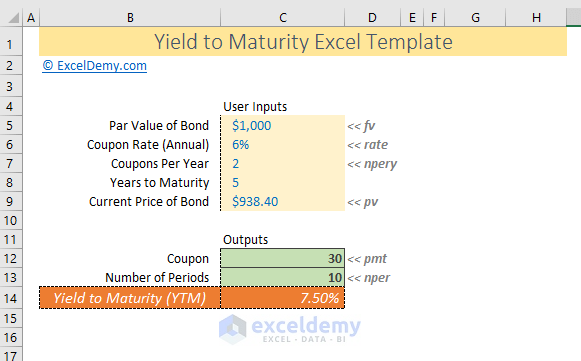

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Solved X 5 X Home Calculating Yield To Maturity Exc Chegg Com

Calculating Bond S Yield To Maturity Using Excel Youtube

Bond Yield To Maturity Calculator Printer Driver Printer Batch File

Bond Pricing Formula How To Calculate Bond Price

Vba To Calculate Yield To Maturity Of A Bond

Bond Formula How To Calculate A Bond Examples With Excel Template

Solved All Answers Must Be Entered As A Formula Click Ok Chegg Com

Yield Formula Excel Example

Bond Yield Formula Calculator Example With Excel Template

Zero Coupon Bond Yield Formula With Calculator

Learn To Calculate Yield To Maturity In Ms Excel

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

Bond Pricing Valuation Formulas And Functions In Excel Youtube

1

Compute The Current Bond Price Answer Must Be In Excel Formula Ninja Co Issued 14 Year Bonds Homeworklib

Best Excel Tutorial How To Calculate Yield In Excel

Yield To Maturity Formula Step By Step Calculation With Examples

Bond Valuation And Yield To Maturity Using Excel Youtube

How To Calculate Bond Price In Excel

What Is The Yield To Maturity Ytm Of A Zero Coupon Bond With A Face Value Of 1 000 Current Price Of 0 And Maturity Of 4 0 Years Recall That The Compounding Interval

Free Bond Valuation Yield To Maturity Spreadsheet

What Is Yield To Maturity How To Calculate It Scripbox

Solved All Answers Must Be Entered As A Formula Click Ok Chegg Com

Best Excel Tutorial How To Calculate Yield In Excel

Yield To Maturity Formula Step By Step Calculation With Examples

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

The Dummies Guide To Zero Coupon Bonds

Free Bond Duration And Convexity Spreadsheet

Yield To Maturity Ytm Calculator

Bond Duration Formula Excel Example

Yield To Maturity Approximate Formula With Calculator

Solved All Answers Must Be Entered As A Formula Click Ok Chegg Com

Yield Function Formula Examples Calculate Yield In Excel

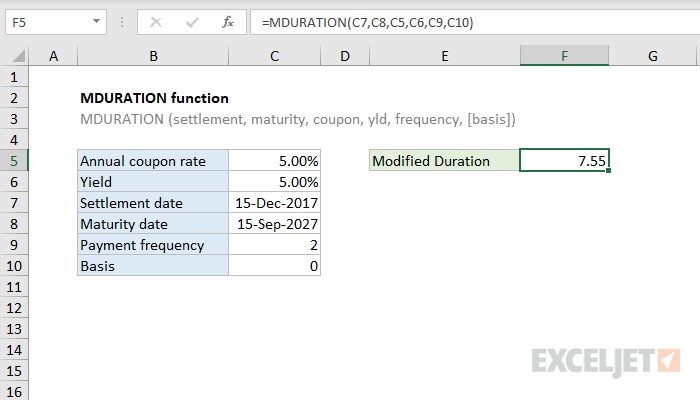

How To Use The Excel Mduration Function Exceljet

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Yield Formula Excel Example

How To Calculate The Yield To Maturity Of A Bond Or Cd With Excel Youtube

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Bond Yield Formula Calculator Example With Excel Template

Ytm Formula Excel

Bond Equivalent Yield Formula Calculator Excel Template

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Bond Equivalent Yield Formula Calculator Excel Template

How To Use The Excel Tbillyield Function Exceljet

Cost Of Debt Definition Formula Calculation Example

A What Is The Maturity Of The Bond In Years Maturity Of The Bond 2 10 Years Course Hero

Yield To Maturity Ytm Overview Formula And Importance

コメント

コメントを投稿